If your business needs cash to purchase technical assistance or to commercialize your products, you can score a substantial amount of capital with this grant. This is a matching grant, so you’ll need to put up half of the cash.

In the SME market, early-stage equity finance is usually provided by venture capital companies (VC), while mid-stage or larger expansion funding requirements for medium size enterprises are provided by private equity funds or bank loans. VCs look for businesses with a strong founder, that have proven product market fit, a team to execute the business plan and a robust business model showing strong future returns. Funding amounts usually vary from R1 million to R20 million.

1Check your business's eligibility in minutes. Fill out the short and sweet online questionnaire. 2Customize your loan. Choose your loan amount and term within your business's estimated eligibility range.3Underwriting review. If any other documents are needed, we'll reach out to you. You can monitor your progress in our portal.4Get your funds. If approved, sign your loan agreement and your loan will be securely transferred from the lender into your PayPal Business account.

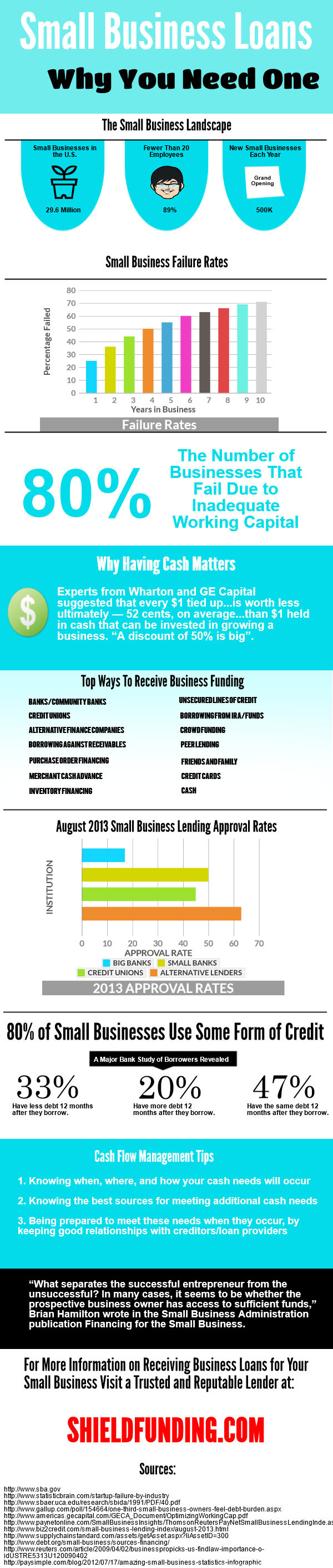

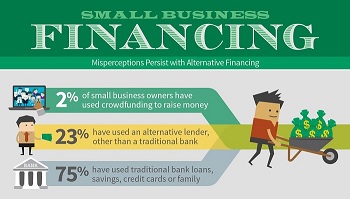

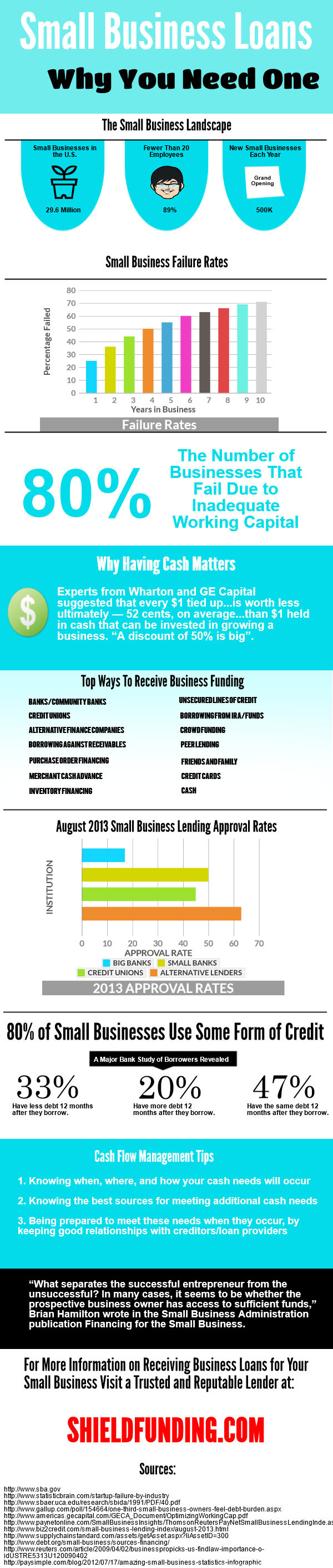

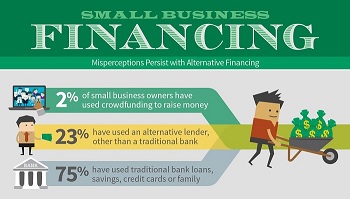

Unlike traditional bank loans, our small business funding partners offer legitimate alternative small business advances. Banks require massive amounts of paperwork and make you jump through hoops to apply. Traditional bank loan approval rates as of December 2013 are less than 17%. Not only that but it can take weeks, if not months, to approve you at a traditional bank. Our small business funding partners approve over 90% of the applicants. They can receive funding in as little as 48 to 72 hours. We focus on all small businesses including women-owned and veteran-owned businesses. Whether you are in need of unsecured revenue based working capital, asset based funding, merchant cash advances, or receivables factoring, we work hard to find a home for your business’ financial needs.

Though an international program, Walmart’s GWEEI should still be on your list if you’re a female business owner: they’ve pledged to support women-owned businesses with over $100 million in grants. Although a lot of this money goes to overseas businesses, some is reserved for women-owned businesses in the US.

We recommend the following ways to finance your business: Funding optionWhy we recommendFind a lender Term loan With a year in business and growing revenue, a term loan can provide a lump sum you can repay over a set period of time. Compare lenders with NerdWallet's loan tool Line of Credit With growing revenue, a line of credit offers flexible spending and higher credit limits than business credit cards. Compare lenders with NerdWallet's loan tool Personal loan A personal loan can be a source for newer businesses because approval is typically based on your personal credit score. Your rates may be higher if you have poor credit. NerdWallet recommends taking a maximum of $35,000 to fund your business. Compare lenders with NerdWallet's loan tool Microloan Since your business is growing, a microloan is a good option if you're looking for reasonable rates. Some microlenders work with entrepreneurs who are building their personal credit and their business. Compare microlenders at NerdWallet

1. How does a PayPal Business Loan work?You must complete a 5-10 minute online questionnaire to determine your business’s eligibility or by calling a Business Funding Expert at 1-800-941-5614. Once the questionnaire is complete, estimated loan terms can be customized by adjusting the loan amount and duration to compare the costs of financing. Once you select your desired terms and completed the application, if approved, you will be prompted to electronically sign a contract that will be emailed to you and includes bank instructions so that payments can be debited weekly from your business checking account.

70-80% of small businesses don’t survive their first year, says Proudly South African CEO, Eustace Mashimbye, with only 9% surviving 10 years. Incubators were developed to reduce the chances of failure of start-ups by offering sustainable and fundamental entrepreneurial support.

We recommend the following ways to finance your business: Funding optionWhy we recommendFind a lender Line of Credit With growing revenue, a line of credit offers flexible spending and higher credit limits than business credit cards. Compare lenders with NerdWallet's loan tool Invoice Factoring You can turn your unpaid customer invoices or receivables into upfront cash. Your personal credit is not a major factor. Invoice factoring is a good option to manage cash-flow gaps. Compare lenders with NerdWallet's loan tool Personal loan A personal loan can be a source for newer businesses because approval is typically based on your personal credit score. Your rates may be higher if you have poor credit. NerdWallet recommends taking a maximum of $35,000 to fund your business. Compare lenders with NerdWallet's loan tool Microloan Since your business is growing, a microloan is a good option if you're looking for reasonable rates. Some microlenders work with entrepreneurs who are building their personal credit and their business. Compare microlenders at NerdWallet

In the SME market, early-stage equity finance is usually provided by venture capital companies (VC), while mid-stage or larger expansion funding requirements for medium size enterprises are provided by private equity funds or bank loans. VCs look for businesses with a strong founder, that have proven product market fit, a team to execute the business plan and a robust business model showing strong future returns. Funding amounts usually vary from R1 million to R20 million.

1Check your business's eligibility in minutes. Fill out the short and sweet online questionnaire. 2Customize your loan. Choose your loan amount and term within your business's estimated eligibility range.3Underwriting review. If any other documents are needed, we'll reach out to you. You can monitor your progress in our portal.4Get your funds. If approved, sign your loan agreement and your loan will be securely transferred from the lender into your PayPal Business account.

Unlike traditional bank loans, our small business funding partners offer legitimate alternative small business advances. Banks require massive amounts of paperwork and make you jump through hoops to apply. Traditional bank loan approval rates as of December 2013 are less than 17%. Not only that but it can take weeks, if not months, to approve you at a traditional bank. Our small business funding partners approve over 90% of the applicants. They can receive funding in as little as 48 to 72 hours. We focus on all small businesses including women-owned and veteran-owned businesses. Whether you are in need of unsecured revenue based working capital, asset based funding, merchant cash advances, or receivables factoring, we work hard to find a home for your business’ financial needs.

Though an international program, Walmart’s GWEEI should still be on your list if you’re a female business owner: they’ve pledged to support women-owned businesses with over $100 million in grants. Although a lot of this money goes to overseas businesses, some is reserved for women-owned businesses in the US.

We recommend the following ways to finance your business: Funding optionWhy we recommendFind a lender Term loan With a year in business and growing revenue, a term loan can provide a lump sum you can repay over a set period of time. Compare lenders with NerdWallet's loan tool Line of Credit With growing revenue, a line of credit offers flexible spending and higher credit limits than business credit cards. Compare lenders with NerdWallet's loan tool Personal loan A personal loan can be a source for newer businesses because approval is typically based on your personal credit score. Your rates may be higher if you have poor credit. NerdWallet recommends taking a maximum of $35,000 to fund your business. Compare lenders with NerdWallet's loan tool Microloan Since your business is growing, a microloan is a good option if you're looking for reasonable rates. Some microlenders work with entrepreneurs who are building their personal credit and their business. Compare microlenders at NerdWallet

1. How does a PayPal Business Loan work?You must complete a 5-10 minute online questionnaire to determine your business’s eligibility or by calling a Business Funding Expert at 1-800-941-5614. Once the questionnaire is complete, estimated loan terms can be customized by adjusting the loan amount and duration to compare the costs of financing. Once you select your desired terms and completed the application, if approved, you will be prompted to electronically sign a contract that will be emailed to you and includes bank instructions so that payments can be debited weekly from your business checking account.

70-80% of small businesses don’t survive their first year, says Proudly South African CEO, Eustace Mashimbye, with only 9% surviving 10 years. Incubators were developed to reduce the chances of failure of start-ups by offering sustainable and fundamental entrepreneurial support.

We recommend the following ways to finance your business: Funding optionWhy we recommendFind a lender Line of Credit With growing revenue, a line of credit offers flexible spending and higher credit limits than business credit cards. Compare lenders with NerdWallet's loan tool Invoice Factoring You can turn your unpaid customer invoices or receivables into upfront cash. Your personal credit is not a major factor. Invoice factoring is a good option to manage cash-flow gaps. Compare lenders with NerdWallet's loan tool Personal loan A personal loan can be a source for newer businesses because approval is typically based on your personal credit score. Your rates may be higher if you have poor credit. NerdWallet recommends taking a maximum of $35,000 to fund your business. Compare lenders with NerdWallet's loan tool Microloan Since your business is growing, a microloan is a good option if you're looking for reasonable rates. Some microlenders work with entrepreneurs who are building their personal credit and their business. Compare microlenders at NerdWallet

Word Count: 835

0 Response to "small business funding"

Posting Komentar